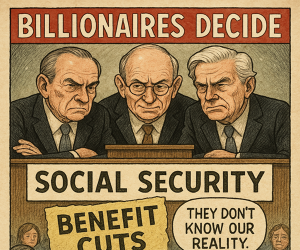

The future of America’s Social Security system is increasingly resembling a dangerous game of chance. For Americans who have diligently paid taxes for decades to secure their retirement, Social Security benefits now feel like an unreliable wager. While someone must inevitably bear the burden to sustain the system, the identity of these victims remains undetermined. The approaching trust fund depletion deadline (2034-2035) is pushing the Social Security system toward a precipice.

The Beginning of an Unfair Game: Contributors vs. Free Riders

America’s Social Security system was originally designed as an intergenerational support structure funded by worker contributions. However, a serious equity issue has emerged between those who contribute and those who do not. Middle-class and high-income earners who have faithfully paid taxes for decades now face the threat of benefit reductions as retirement approaches, while some lower-income individuals who have paid minimal taxes continue to enjoy guaranteed payments and healthcare benefits.

The burden on workers intensifies when considering not only Social Security Administration (SSA) benefits but also Supplemental Security Income (SSI) and Medicaid for low-income populations. In a reality where many receive welfare benefits without paying income taxes, those who have worked conscientiously find themselves at a disadvantage.

2035: The Year the Fateful Bullet Fires

Under current projections, the Social Security fund will be completely depleted by 2035, after which benefits would likely be reduced to 75-80% of promised levels, funded solely by incoming tax revenue.

This presents a particularly devastating blow to the Baby Boomer generation approaching retirement. For those who have steadily contributed for decades to receive less than anticipated benefits, the situation will feel nothing short of betrayal.

Who Will Be Sacrificed?

Reform proposals to address this crisis will inevitably demand significant sacrifices from certain groups:

- Future Working Generations – Increasing Social Security payroll taxes (FICA) could replenish the fund but would substantially increase the tax burden on the working population. This could lead to slower economic growth and reduced real income.

- High-Income Earners and the Middle Class – Democrats favor imposing additional Social Security taxes on those earning above $160,200 annually. However, this measure could potentially trigger tax avoidance among corporations and the wealthy, while dampening investment.

- Near-Retirement Generation – Republican reform proposals include raising the benefit eligibility age from 67 to 69-70. This would prove especially harsh for manual laborers.

- Current Recipients – In extreme scenarios, benefits for current retirees might be adjusted. This would face the strongest political resistance and likely provoke intense public backlash.

- Welfare Beneficiaries – This represents the most contentious area. Discussions may include strengthening eligibility requirements for individuals currently receiving welfare benefits such as SSI or Medicaid. However, Democrats would strongly oppose such measures, potentially deepening political divisions.

Time to Pull the Trigger on Russian Roulette

Reform of America’s Social Security system has become an unavoidable reality. Yet regardless of the approach taken, strong opposition will emerge from certain quarters, and whoever bears the sacrifice will inevitably feel wronged. Ultimately, which group will take the bullet in this massive game of Russian roulette?

The longer the government delays its decision, the closer this moment approaches. Will a solution emerge to overcome the crisis in America’s Social Security system, or will unwanted sacrifices be forced upon someone?

10년 전 DUI 기록 문제돼 갑자기 비자취소 통보받아

10년 전 DUI 기록 문제돼 갑자기 비자취소 통보받아